riverside mo sales tax rate

Enter your street address and city or zip code to view the sales and use tax rate information for your address. State Tax Rates.

California Sales Tax Guide For Businesses

Find Sales and Use Tax Rates.

. The state sales tax rate is 4225. The Riverside California sales tax is 875 consisting of 600 California state sales tax and 275 Riverside local sales taxesThe local. This rate includes any state county city and local sales taxes.

Cities counties and certain districts may also impose local sales taxes as well so the amount of tax sellers collect from the purchaser depends on the. With local taxes the total sales tax rate is between 4225 and 10350. Local tax rates in.

The latest sales tax rate for Cameron MO. You can print a. Statewide salesuse tax rates for the.

The Missouri Department of Revenue administers Missouris business tax laws and collects sales and use tax employer withholding motor fuel tax cigarette tax. The use tax rate for the City of Riverside is currently 66 percent which is equal to the total local sales tax rate. What is the sales tax rate in Riverside California.

Missouri MO Sales Tax Rates by City R The state sales tax rate in Missouri is 4225. The latest sales tax rate for Riverside MO. Indicates required field.

The minimum combined 2022 sales tax rate for Riverside California is. You may also call 573-751. A Vendor No Tax Due can be obtained by contacting the Missouri Department of Revenue Taxation Division PO Box 3666 Jefferson City MO 65105-3666.

2020 rates included for use while preparing your income tax deduction. An alternative sales tax rate of 885 applies in the tax region Kansas City which appertains to zip code 64150. The local sales tax rate in Kansas City Missouri is 885 as of January 2022.

Sales tax jurisdiction is City of Riverside. The average cumulative sales tax rate in Riverside Missouri is 71. You can find more tax rates and.

Download all California sales tax rates by zip code. The Riverside Missouri sales tax is 660 consisting of 423 Missouri state sales tax and 238 Riverside local sales taxesThe local sales tax consists of a 138 county sales tax and. In Riverside Missouri Sales tax rate in Riverside Missouri is 6600.

Riverview Estates MO Sales Tax Rate. The Riverside Missouri sales tax rate of 71 applies in the zip code 64150. This is the total of state county and city sales tax rates.

This rate includes any state county city and local sales taxes. Fortescue MO Sales Tax Rate. 2020 rates included for use while preparing your income tax deduction.

Riverside is located within Platte County. This includes the rates on the state county city and special levels. Sales tax rate in Riverside Missouri is 6600.

Riverside in Missouri has a tax rate of 66 for 2022 this includes the Missouri Sales Tax Rate of 423 and Local Sales Tax Rates in Riverside totaling 237. The Missouri Department of Revenue administers Missouris business tax laws and collects sales and use tax employer withholding motor fuel tax. Certain purchases from out-of-state vendors will become subject to an.

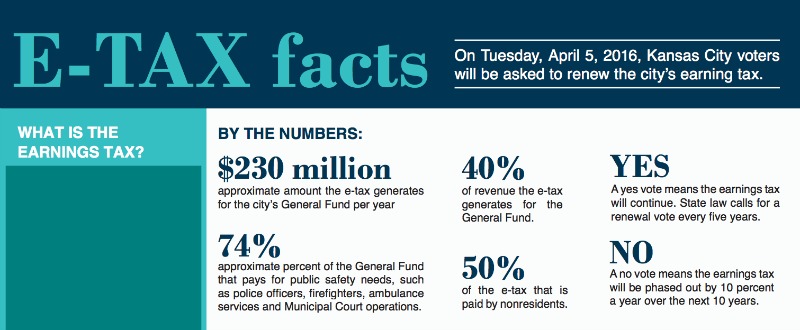

Facts About The Kansas City Earning Tax Martin City Cid

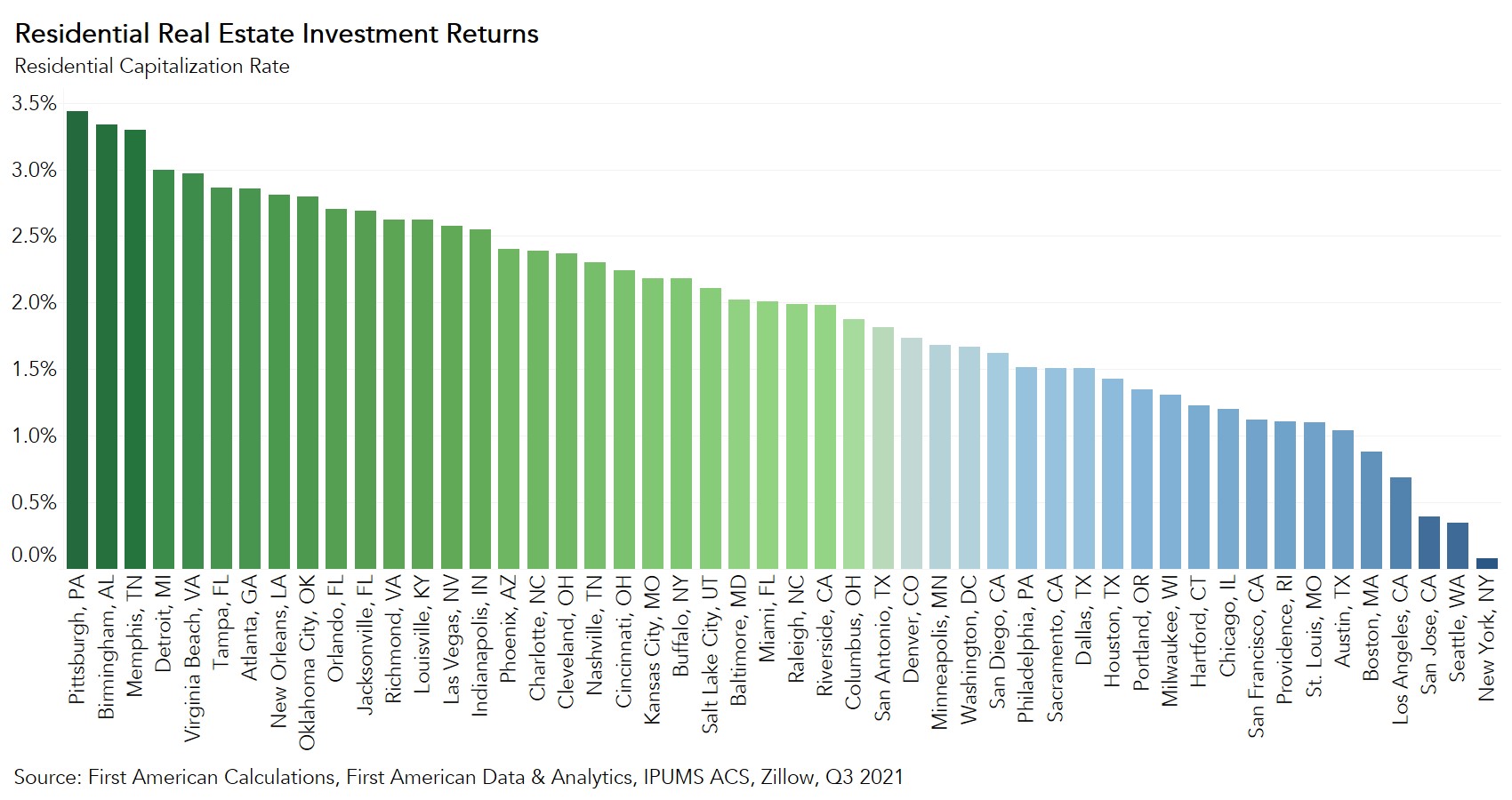

Where Can Residential Real Estate Investors Find The Most Potential Roi

Jackson County Mo Property Tax Calculator Smartasset

How High Are Property Taxes In Your State Tax Foundation

What Do Springfield Residents Pay In Sales Tax

2900 Nw 47th St Riverside Mo 64150 Land For Sale Loopnet

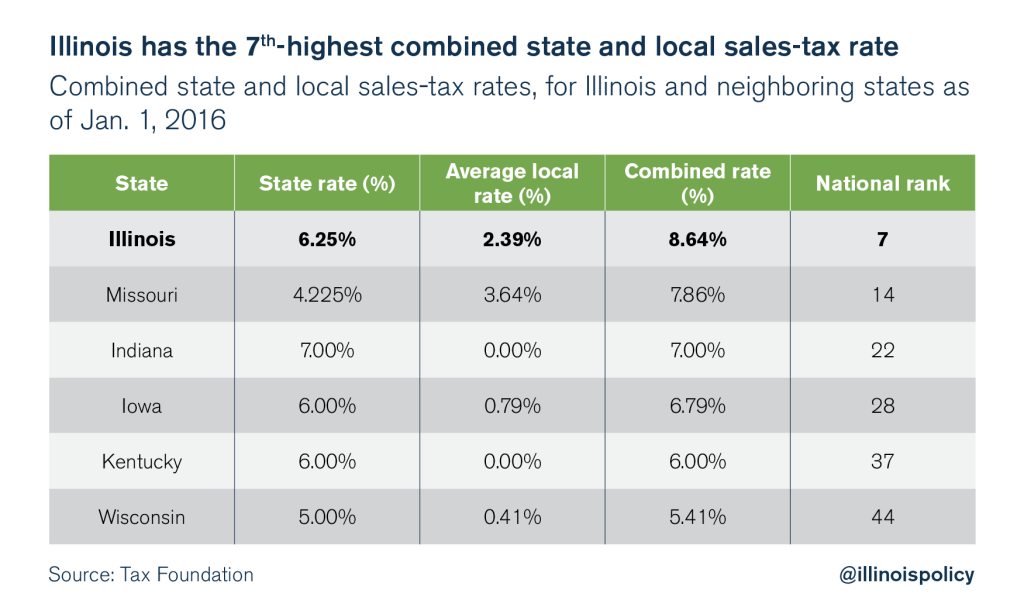

Illinois Is A High Tax State Illinois Policy

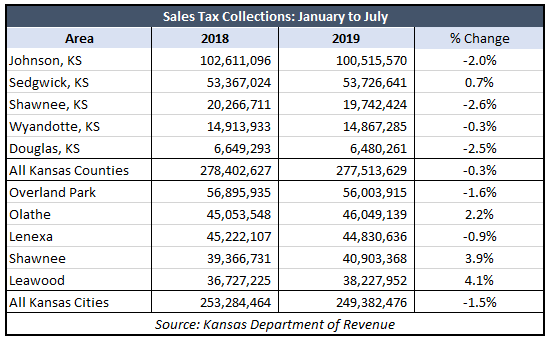

Local Officials Learning Tax Hikes Doom Consumer Spending Kansas Policy Institute

Missouri Income Tax Calculator Smartasset

Property Tax City Of Raymore Mo

Johnson County Worries Sales Tax Commercial Property Tax The Kansas City Star

Do I Need To Pay Tax On Selling A Home Zillow

Property Tax Calculator Estimator For Real Estate And Homes

Connecticut Sales Tax Rates By City County 2022

Understanding California S Sales Tax

Understanding California S Sales Tax